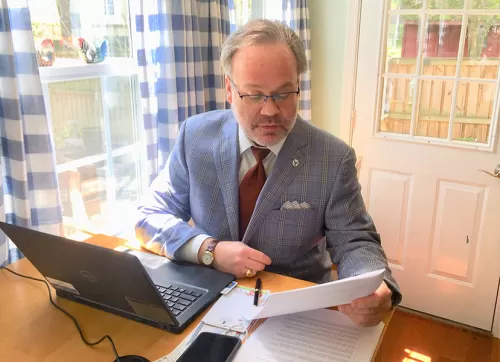

NCUA Board Member Todd M. Harper provides remarks from his home during the agency's April 2020 Board meeting.

As Prepared for Delivery on April 16, 2020

Thank you, Mr. Chairman. Like you, I have spent my days and weeks focused on mitigating the impact of the COVID-19 pandemic on the credit union system and ensuring that credit union members have access to much-needed credit during these difficult economic times. Last April, you and I each took the oath of office and became NCUA Board Members. Neither of us had any idea that 12 months later, we would be in the midst of a global crisis.

As we continue to face this significant public health challenge, I am extremely proud of the work of the NCUA team. As financial first responders, they have risen to the occasion. They are working to identify problems, develop creative solutions, and bolster the credit union system for what lies ahead. Most of all, they are focused on the more than 120 million members of the credit union system who count on the NCUA to protect them and their share deposits, and to ensure access to credit.

In addition to internal briefings on economic activity, pandemic planning, examination program changes, and credit union system updates, I have spent my time speaking with regulators, credit union leaders, industry experts, and consumer advocates. Through these calls, I have identified problems like the need to: provide greater regulatory flexibility in holding annual meetings, assist credit unions in gaining access to the SBA’s Paycheck Protection Program, delay comment periods on pending rulemakings, and facilitate access to grants and funding.

Moreover, the NCUA staff has responded quickly to these problems, including as I urged securing the legislative changes needed to provide all credit unions with temporary enhanced access to liquidity through the NCUA’s Central Liquidity Facility.

The temporary changes made to the Central Liquidity Facility are very helpful, but they may be too short in length because liquidity needs seem likely to hit their highest point next year. As such, I hope that Congress will make the Central Liquidity Fund provisions in the CARES Act permanent or extend their sunset by at least one year to December 31, 2021.

In any future legislative product, it would also be helpful to temporarily exempt all member business loans made on or before the start of the COVID-19 public health emergency through December 31, 2020 from the member business lending cap. The change would promote access to credit for small business and keep the economy going.

Additionally, we have seen a strong demand for urgent needs and the COVID-19 emergency grants offered under the NCUA’s Community Development Revolving Loan Fund. Accordingly, I recommend that we seek an additional $10 million in appropriations for these emergency grants.

The funding would help low-income credit unions adjust their operations, preserve capital, and effectively respond to the many state stay-at-home and social distancing orders presently in place to fight against the spread of COVID-19.

Because underserved communities are especially hard hit by COVID-19, we should ask Congress to allow all federal charter types to add underserved areas to their field of membership. This common-sense change would provide more Americans with access to safe financial products and services and affordable credit.

Finally, in responding to the COVID-19, credit unions have less time to conduct due diligence and to respond to problems with their vendors. Consistent with the long-standing recommendations of the Government Accountability Office and the Financial Stability Oversight Council, now is the time to authorize the NCUA to supervise credit union third-party vendors. Doing so will close a regulatory blind spot and better protect the safety and soundness of the credit union system.

In sum, Mr. Chairman, although the world has changed considerably since you and I joined the NCUA Board, I am more committed than ever to serving the members and credit unions that comprise the system, as well as the NCUA staff.

I will continue to advocate for common sense regulatory and legislative changes designed to mitigate this crisis. And, while we will likely have many difficult days and more economic turbulence ahead, we will get through the COVID-19 pandemic together by focusing on serving the needs of credit union members.

Thank you, Mr. Chairman. I have no further comments.