As Prepared for Delivery on January 26, 2023

Thank you, John, for your presentation.

When, in 1980, Congress raised the credit union interest rate ceiling to 15 percent, from the statutory limit of 12 percent, they also gave the NCUA Board the discretion to increase the interest rate cap for safety and soundness for periods not to exceed 18 months. The reason Congress acted was because back in 1980, the Fed was hiking rates to unprecedented levels. Immediately after that 1980 legislation, the Board used that discretion to raise the maximum rate to 21 percent where it stayed for a few years. This is the context I’m working with when trying to understand Congressional intent. We know that Congress thought 21 percent was appropriate when the Prime rate was 20.5 percent. I mention this because our job is to do what Congress says, not what we on the Board think is the ideal policy.

If the Board doesn’t take any action, the maximum rate falls back to the statutory level of 15 percent. I’m going to vote today to keep the current elevated cap of 18 percent. One thing that’s interesting to me is that the only rate that appears in our current statute is 15 percent, a rate that’s never actually been used.

Although I will be voting for this proposal today, I am concerned that we may need more information than what we had available to us to make this determination. We do know that Congress said we can only go above 15 percent if “the safety and soundness of individual credit unions as evidenced by adverse trends in liquidity, capital, earnings and growth.” As of this moment, we do not have evidence that meets the rather-stringent criteria to raise the rate higher than the current 18 percent.

Low-income and CDFI credit unions depend upon the ‘head room,’ the ceiling provides above the statutory rate of 15 percent. With inflation and the increase of the cost of funds, these credit unions will have to make the hard choice of whether to serve their neediest members. For some low-income community and CDFI credit unions, this could be most of their membership.

Some have said that one solution is Payday Alternative Loans (PALs), a higher-interest loan allowed by NCUA. I don’t disagree the PALs product can be a useful option. But most credit unions don’t make PALs loans. My informal research has revealed that it takes on average three to five days for a credit union to process a PALs loan. And this is often at a loss or breakeven due to the manual nature of the process. Some credit unions have found ways to provide these loans economically and quickly through technology – I’m aware of at least one CUSO offering a technology solution that shortens the response time to a matter of minutes.

So, the PALs product often doesn’t work for either the credit union or their members. With inflation and rates rising, my guess is emergencies have gotten more expensive too. Emergencies, by definition, arrive unexpectedly and are often time sensitive. And as I said, CDFI credit unions and LICUs may not have the option to simply become prime lenders. This is the sort of information we’d like to examine further.

I’d also like to say that I’ve been there, needing cash in the next 24 or 48 hours without any good options. For many of us, the cash crunch stems from owing government money. I understand why the public can get irritated by government lecturing us on usurious lending rates. Currently 18 states and Washington, DC impose a 36 percent rate cap or lower – I live in DC and the cap is 24 percent to borrow money to pay needed bills. Yet in 2013, I filed an extension for my DC income taxes and paid in October instead of April. Guess what I was charged? They charged me an extra 30 percent!

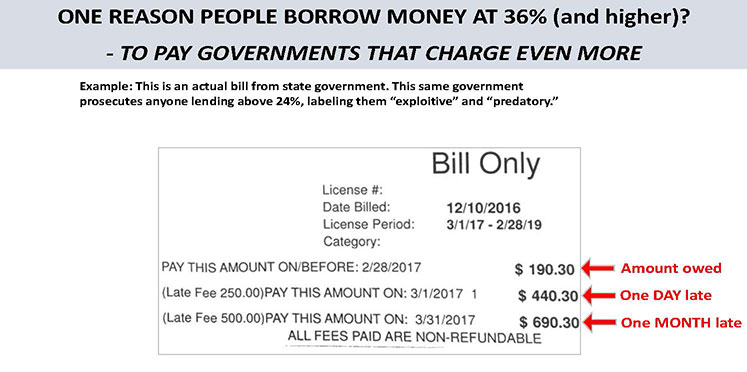

One more example: below is an actual bill from state government, a government that prosecutes anyone lending 24 percent, and they call higher rates “predatory” and “exploitive.”

Well, if you owe that government $190, it’s $440 if you’re one day late. It’s $690 if you’re one month late. This is one example of why people get financially stuck sometimes. They don’t want government to put a boot on their car for unpaid parking tickets (the cost of which can double if not paid in 30 days!), or their car towed due to not having the money to pay Registration fees, nor their business shut down for unpaid permits.

Last thing on that slide: Let’s say I couldn’t pay the government’s $190 fee and don’t want to pay the government’s $500 fee for being a month late. Couldn’t I just borrow $190 from a local lender and pay them back a month later with, say $30 in interest, thereby avoiding the government’s $500 fine? Nope, because that $30 in interest is deemed predatory lending by the same government levying the $500 fine.

Remarkable, isn’t it? I’m not here to say I know exactly how much anyone should pay in fees or interest. I’m just saying I feel your pain if you’re financially jammed up, and that there is inconsistency at some levels of government between a) what’s ‘predatory’ when citizens owe each other money, and b) what’s appropriate when we owe the government money.

So, back today’s vote. I believe we need to do further research on the impact of the rate cap on the safety and soundness of individual credit unions.

Mr. Chairman do you agree to have E&I reevaluate the interest rate ceiling in accordance with the Federal Credit Union Act and add that reevaluation as an agenda item at the April Board meeting?

Mr. Chairman will you also work to ensure that the analysis of whether a floating interest rate is legal is completed by the NCUA’s General Counsel’s Office by the April board meeting? If a floating interest rate is determined to be legal, I understand that next steps may not be available for action until after the April Board meeting.

Thank you, Mr. Chairman for your willingness to work with me on this issue. Thank you, Board Member Hood, for your support.

Thank you, Mr. Chairman. This concludes my remarks.