Overview

The Military Lending Act (MLA), 10 U.S.C. § 987, enacted in 2006 and implemented by the Department of Defense (DoD), protects active duty members of the military, their spouses, and their dependents from certain lending practices.

The DoD regulation, 32 CFR Part 232, implementing the MLA contains limitations on and requirements for certain types of consumer credit extended to active duty service members and their spouses, children, and certain other dependents (“covered borrowers”). Subject to certain exceptions, the regulation generally applies to persons who meet the definition of a creditor in Regulation Z and are engaged in the business of extending such credit, as well as their assignees.

For covered transactions, the MLA and the implementing regulation limit the amount a creditor may charge, including interest, fees, and charges imposed for credit insurance, debt cancellation and suspension, and other credit-related ancillary products sold in connection with the transaction. The total charge, as expressed through an annualized rate referred to as the Military Annual Percentage Rate (MAPR) [1] may not exceed 36 percent. [2] The MAPR includes charges that are not included in the finance charge or the annual percentage rate (APR) disclosed under the Truth in Lending Act (TILA). [3]

In addition, among other provisions, the MLA, as implemented by DoD:

- Provides an optional safe harbor from liability for certain procedures that creditors may use in connection with identifying covered borrowers;

- Requires creditors to provide written and oral disclosures in addition to those required by TILA;

- Prohibits certain loan terms, such as prepayment penalties [4], mandatory arbitration clauses, and certain unreasonable notice requirements; and

- Restricts loan rollovers, renewals, and refinancing by some types of creditors.

Statutory amendments to the MLA in 2013 granted enforcement authority for the MLA’s requirements to the agencies specified in section 108 of TILA. [5] These agencies include the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, and the Federal Trade Commission. State regulators also supervise state-chartered institutions for MLA requirements pursuant to authority granted by state law.

In July 2015, DoD published revisions to the MLA implementing regulation [6] that:

- Extend the MLA’s protections to a broader range of credit products;

- Modify the MAPR to include certain additional fees and charges;

- Alter the provisions of the optional safe harbor available to creditors for identification of covered borrowers;

- Modify the disclosures creditors are required to provide to covered borrowers;

- Modify the prohibition on rolling over, renewing, or refinancing consumer credit; and

- Implement statutory changes, including provisions related to administrative enforcement and civil liability for MLA violations (for knowingly violating the MLA, there is potential for criminal penalties).

Previously, the MLA regulation only applied to certain types of credit, namely: narrowly defined payday loans, motor vehicle title loans, and tax refund anticipation loans with particular terms. The current rule defines “consumer credit” subject to the MLA much more broadly, generally paralleling the definition in Regulation Z. Some examples of additional credit products now subject to MLA protections when made to covered borrowers include:

- Credit cards;

- Deposit advance products;

- Overdraft lines of credit (but not traditional overdraft services); [7] and

- Certain installment loans (but not installment loans expressly intended to finance the purchase of a vehicle or personal property when the credit is secured by the vehicle or personal property being purchased).

Credit agreements that violate the MLA are void from inception. For most products, creditors are required to come into compliance with DoD’s July 2015 rule on October 3, 2016. For credit card accounts, creditors are not required to come into compliance with the rule until October 3, 2017. [8]

You can find the full text of the MLA here.

You can find the full text of the implementing regulation here.

Associated Risks

Compliance risk can occur when the credit union fails to implement the necessary controls to comply with the MLA.

Reputation risk can occur when members of the credit union learn of its failure to comply with the MLA.

Examination Objectives

- Determine the credit union’s compliance with the provisions of the MLA, as applicable.

- Assess the quality of the credit union’s compliance risk management systems and its policies and procedures for implementing the provisions.

- Determine the reliance that can be placed on the credit union’s internal controls and procedures for monitoring the credit union’s compliance with the provisions.

- Determine corrective action when violations of law are identified or when the credit union’s policies, procedures, or internal controls are deficient.

Examination Procedures [9]

Determine Applicability of the Regulation

- Determine if the credit union offers or purchases consumer credit covered by 32 CFR 232.

- If the credit union does not offer or purchase the types of credit that would be consumer credit within the meaning of the MLA, the regulation does not apply and no further review is necessary;

- If the credit union offers or purchases any of the types of credit that would be consumer credit within the meaning of the MLA, use the following procedures to determine whether the credit union complies with the MLA.

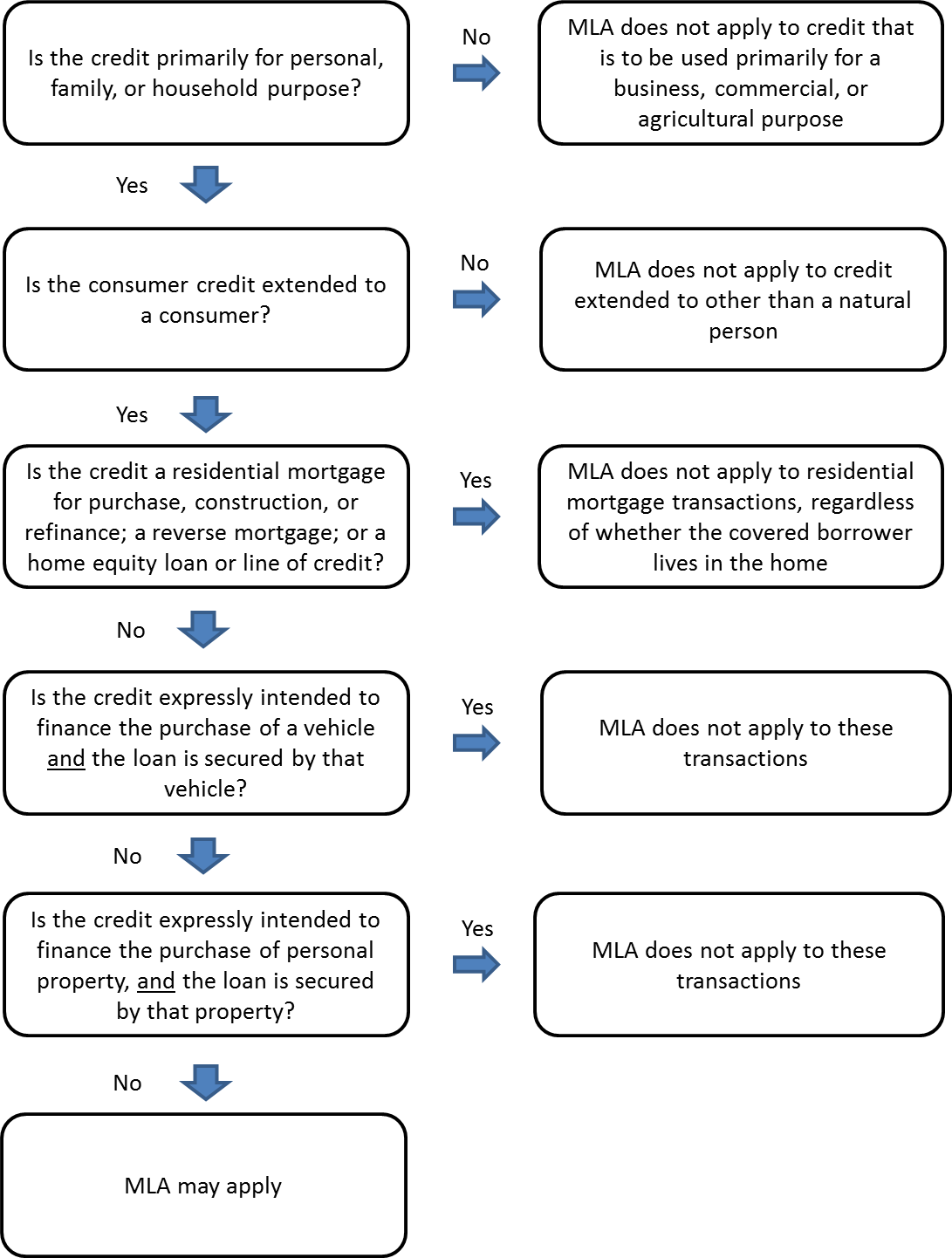

The following flowchart may be helpful in determining MLA applicability to a particular extension of credit to a covered borrower:

Flowchart Alternative Text

Is the Credit primarily for personal, family, or household purpose? If no, the MLA does not apply to the credit that is to be used primarily for a business, commercial, or agricultural purpose.

If yes, then, is the consumer credit extended to a consumer? If no, the MLA does not apply to credit extended to the other than a natural person.

If yes, is the credit a residential mortgage for purchase, construction, or refinance; a reverse mortgage; or a home equity loan or line of credit? If yes, the MLA does not apply to residential mortgage transactions regardless of whether the covered borrower lives in the home.

If no, is the credit expressly intended to finance the purchase of a vehicle and the loan is secured by that vehicle? If yes, the MLA does not apply to these transactions.

If no, is the credit expressly intended to finance the purchase of personal property, and the loan is secured by that property? If yes, the MLA does not apply to these transactions.

If no, the MLA may apply.

Evaluate Compliance Management System

- Determine the extent and adequacy of the credit union’s policies, procedures, and practices for ensuring and monitoring compliance with the MLA.

- Determine the extent and adequacy of the training received by individuals whose responsibilities relate to compliance with the MLA. Review any training materials pertaining to the MLA and determine whether the training is comprehensive and covers the various aspects of the provisions that apply to the credit union’s offerings and operations.

- Determine if the credit union has policies or procedures in place to:

- Provide account disclosure information to covered borrowers in accordance with § 232.6;

- Correctly determine which fees it charges are required to be included in the calculation of the MAPR;

- Correctly calculate and limit the MAPR (including waiving amounts necessary in order to comply with the limit at the outset of a transaction and at the end of a billing cycle on open-end credit, as applicable) as defined in § 232.3(p) and in accordance with § 232.4(c); and

- Properly create and maintain records of covered borrower checks.

- Obtain compliance reviews and/or audit materials, including workpapers and reports, to determine if:

- The scope of any audits address all provisions of the regulation, as applicable;

- Transaction testing includes samples covering all relevant product types and decision centers;

- The work performed is accurate;

- Significant deficiencies and their causes are included in reports to management or to the board of directors;

- Management has taken corrective actions to follow up on previously identified deficiencies; and

- The frequency of review/audit is appropriate (including review/audit of implemented corrective action related to previously identified deficiencies).

- Through discussions with management and review of available information, determine whether the credit union’s internal controls are adequate to ensure compliance. Consider the following:

- Organization charts;

- Process flowcharts;

- Policies and procedures;

- Account documentation;

- Checklists; and

- Computer program documentation, including any computer program testing and validation.

Identification of Covered Borrowers

- Determine whether the credit union’s policies, procedures, and training materials accurately reflect the scope of the “covered borrower” definition.

Note: If credit union elects not to enact policies and procedures to check for covered borrower status, they may be at higher risk for making non-compliant loans. Examiners may wish to focus any file review activities on the ability of the credit union to accurately ascertain covered borrower status on an ad hoc basis. - Determine whether the credit union has elected to use one of the optional safe harbor methods provided in § 232.5(b). If the credit union does not use one of the optional safe harbor methods, describe the method, if any, which the credit union uses to ensure it does not make covered loans to covered borrowers on prohibited terms.

- If a credit union elects to use one of the two optional safe harbor methods to check a member’s status, ascertain whether the credit union timely creates and thereafter maintains a record of the information obtained, in accordance with § 232.5(b)(3).

- If a credit union elects to use a method other than one of the two optional safe harbor methods, determine whether the chosen method is performed prior to a member becoming obligated on a credit transaction or establishing an account for credit and whether the credit union maintains a record of the information obtained.

Note: § 232.5 contains no specific timing and recordkeeping requirements if the credit union uses an alternative to one of the safe harbors to verify covered borrower status. However, any alternative method selected by the credit union should be evaluated to determine whether it is reasonable and verifiable, and whether it addresses the risk of extending consumer credit that does not comply with the MLA to a covered borrower.

- Regarding an action by a credit union relating to a covered borrower with an existing account, if a credit union has elected to use one of the two optional safe harbor methods, determine whether the credit union also uses one of the safe harbor methods when extending a new consumer credit product or newly establishing an account for consumer credit, including a new line of consumer credit that might be associated with a pre-existing transactional account held by the borrower.

Calculation of MAPR

- Determine whether the credit union includes the following charges in the calculation of the MAPR for both closed- and open-end credit, as applicable:

- Any credit insurance premium or fee, any charge for single premium credit insurance, any fee for a debt cancellation contract, or any fee for a debt suspension agreement;

- Any fee for a credit-related ancillary product sold in connection with the credit transaction for closed-end credit or an account for open-end credit; and

- Except for a bona fide fee (other than a periodic rate) charged to a credit card account, which may be excluded if the bona fide fee is reasonable for that type of fee:

- Finance charges associated with the consumer credit;

- Any application fee charged to a covered borrower who applies for consumer credit, other than an application fee charged by a federal credit union when making a short-term, small amount loan provided that the application fee is charged to the covered borrower not more than once in any rolling 12-month period; and

- Any fee imposed for participation in any plan or arrangement for consumer credit other than as permitted under §232.4(c)(2)(ii)(B).

- For closed-end credit, determine whether the credit union appropriately calculates the MAPR following the rules for calculating and disclosing the “Annual Percentage Rate (APR)” for credit transactions under Regulation Z based on the “Types of Fees to Include in MAPR Calculation” above.

- For open-end credit, determine whether the credit union appropriately calculates the MAPR following the rules for calculating the effective annual percentage rate for a billing cycle as set forth in 12 CFR 1026.14(c) and (d) of Regulation Z (as if the credit union must comply with that section) based on the “Types of Fees to Include in MAPR Calculation” above.

Mandatory Loan Disclosures

- Determine whether the credit union properly provides the covered borrower with required information before or at the time the borrower becomes obligated on the transaction or establishes an account for the consumer credit, including:

- A statement of the MAPR applicable to the extension of consumer credit;

- Any disclosure required by Regulation Z, which shall be provided only in accordance with the requirements of Regulation Z that apply to that disclosure; and

- A clear description of the payment obligation of the covered borrower, as applicable. Note that a payment schedule (in the case of closed-end credit) or account-opening disclosure (in the case of open-end credit) provided pursuant to Regulation Z satisfies this requirement. Also note that for oral disclosures, a generic, clear description of the payment obligation is permissible.

- Determine whether the credit union provides the statement of the MAPR and the clear description of the payment obligation both in writing in a form the covered borrower can keep and orally.

- If the credit union elects to provide a toll-free telephone number in order to deliver the oral disclosures to a covered borrower, determine whether the toll-free telephone number is included on either:

- A form the credit union directs the consumer to use to apply for the transaction or account involving consumer credit; or

- The written disclosure the credit union provides to the covered borrower.

- If the credit union elects to provide a toll-free telephone number in order to deliver the oral disclosures to a covered borrower, determine whether the toll-free telephone number is available for a duration of time reasonably necessary to allow a covered borrower to contact the credit union for the purpose of listening to the disclosure.

Other Limitations

- Determine whether the creditor abides by the prohibition on rolling over, renewing, repaying, refinancing, or consolidating consumer credit. Note that this prohibition does not apply to a creditor that is chartered or licensed under Federal or State law as a bank, savings association, or credit union, or when the credit is being extended by the same creditor to refinance or renew an extension of credit that was not covered because the consumer was not a covered borrower at the time of the original transaction.

- Determine whether the credit union abides by the prohibitions against requiring covered borrowers to:

- Waive their rights to legal recourse under any otherwise applicable law;

- Submit to arbitration or other onerous legal notice provisions in the case of a dispute; or

- Provide unreasonable notice as a condition for legal action.

- Confirm that the creditor does not:

- Require that a covered borrower repay the obligation by military allotment (note that for purposes of this provision of the regulation, the term “creditor” does not include “military welfare societies” or “service relief societies”);

- Prohibit a covered borrower from prepaying the consumer credit; or

- Charge a covered borrower a penalty fee for prepaying all or part of the consumer credit[10].

- Determine whether the creditor abides by the prohibition on using the title of a vehicle as security for the obligation involving the consumer credit. Note that this prohibition does not apply when the transaction is expressly intended to finance the purchase of a vehicle and the credit is secured by the vehicle or when the creditor is chartered under Federal or State law as a bank, savings association, or credit union.

- Determine whether the credit union improperly requires access to a deposit, savings, or other financial account maintained by the covered borrower for repayment by:

- Obtaining payment through a remotely created check or remotely created payment order; or

- Obtaining a post-dated check provided at or around the time credit is extended.

MILITARY LENDING ACT (MLA)

CHECKLIST

Applicability of the Regulation

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 1 | Does the credit union offer, extend, or purchase credit primarily for personal, family, or household purposes? If the answer is Yes, proceed. If the answer is No or N/A, conclude the review. |

Evaluate Compliance Management System

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 2 | Does the credit union have adequate policies, procedures, and practices for ensuring and monitoring compliance with the MLA? | |||

| 3 | Does the credit union provide adequate training for individuals whose responsibilities relate to compliance with the MLA? | |||

| 4 | Does the credit union have policies or procedures in place to: | N/A | N/A | N/A |

| 4(a) | Provide account disclosure information to covered borrowers in accordance with § 232.6; | |||

| 4(b) | Correctly determine which fees that the credit union charges are required to be included in the calculation of the MAPR; | |||

| 4(c) | Correctly calculate and limit the MAPR (including waiving amounts necessary in order to comply with the limit at the outset of a transaction and at the end of a billing cycle on open-end credit, as applicable) as defined in § 232.3(p) and in accordance with § 232.4(c); and | |||

| 4(d) | Properly create and maintain records of covered borrower checks? | |||

| 5 | Based on a review of the credit union’s compliance reviews and/or audit materials, including workpapers and reports: | N/A | N/A | N/A |

| 5(a) | Does the scope of any audits address all provisions of the regulation, as applicable? | |||

| 5(b) | Does transaction testing include samples covering all relevant product types and decision centers? | |||

| 5(c) | Is the work performed accurate? | |||

| 5(d) | Are significant deficiencies and their causes included in reports to management or to the board of directors? | |||

| 5(e) | Has management taken corrective actions to follow up on previously identified deficiencies? | |||

| 5(f) | Is the frequency of review/audit appropriate (including review/audit of implemented corrective action related to previously identified deficiencies)? | |||

| 6 | Are the credit union’s internal controls adequate to ensure compliance? |

Identification of Covered Borrowers

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 7 | Do the credit union’s policies, procedures, and training materials accurately reflect the scope of the “covered borrower” definition? | |||

| 8 | Has the credit union elected to use one of the optional safe harbor methods provided in § 232.5(b)? | |||

| 9 | If a credit union elects to use one of the two optional safe harbor methods to check a consumer’s status: | N/A | N/A | N/A |

| 9(a) | Does the credit union timely create a record of the information obtained, in accordance with § 232.5(b)(3)? | |||

| 9(b) | Does the credit union thereafter maintain a record of the information obtained, in accordance with § 232.5(b)(3)? | |||

| 9(c) | Regarding an action by the credit union relating to a covered borrower with an existing account, does the credit union also use one of the safe harbor methods when extending a new consumer credit product or newly establishing an account for consumer credit, including a new line of consumer credit that might be associated with a pre-existing transactional account held by the borrower? | |||

| 10 | If a credit union elects to use a method other than one of the two optional safe harbor methods: | N/A | N/A | N/A |

| 10(a) | Is the chosen method performed prior to a consumer becoming obligated on a credit transaction or establishing an account for credit? | |||

| 10(b) | Does the credit union maintain a record of the information obtained? |

Calculation of MAPR

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 11 | Does the credit union include the following charges in the calculation of the MAPR for both closed- and open-end credit, as applicable: | N/A | N/A | N/A |

| 11(a) | Any credit insurance premium or fee, any charge for single premium credit insurance, any fee for a debt cancellation contract, or any fee for a debt suspension agreement; | |||

| 11(b) | Any fee for a credit-related ancillary product sold in connection with the credit transaction for closed-end credit or an account for open-end credit; and | |||

| 11(c) | Except for a bona fide fee (other than a periodic rate) charged to a credit card account, which may be excluded if the bona fide fee is reasonable for that type of fee: | N/A | N/A | N/A |

| 11(c)(i) | Finance charges associated with the consumer credit; | |||

| 11(c)(ii) | Any application fee charged to a covered borrower who applies for consumer credit, other than an application fee charged by a federal credit union when making a short-term, small amount loan provided that the application fee is charged to the covered borrower not more than once in any rolling 12-month period; and | |||

| 11(c)(iii) | In general, any fee imposed for participation in any plan or arrangement for consumer credit. | |||

| 12 | For closed-end credit, does the credit union appropriately calculate the MAPR following the rules for calculating and disclosing the “Annual Percentage Rate (APR)” for credit transactions under Regulation Z based on the MAPR charges? | |||

| 13 | For open-end credit, does the credit union appropriately calculate the MAPR following the rules for calculating the effective annual percentage rate for a billing cycle as set forth in 12 CFR § 1026.14(c) and (d) of Regulation Z (as if a credit union must comply with that section) based on the MAPR charges? |

Mandatory Loan Disclosures

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 14 | Does the credit union properly provide each covered borrower with required information before or at the time the borrower becomes obligated on the transaction or establishes an account for the consumer credit, (or at a later time provided for in Regulation Z, if any), including: | N/A | N/A | N/A |

| 14(a) | A statement of the MAPR applicable to the extension of consumer credit; | |||

| 14(b) | Any disclosure required by Regulation Z, which shall be provided only in accordance with the requirements of Regulation Z that apply to that disclosure; and | |||

| 14(c) | A clear description of the payment obligation of the covered borrower, as applicable. Note that a payment schedule (in the case of closed-end credit) or account-opening disclosure (in the case of open-end credit) provided pursuant to Regulation Z satisfies this requirement. | |||

| 15 | Does the credit union provide the statement of the MAPR and the clear description of the payment obligation both in writing in a form the covered borrower can keep and orally? | |||

| 16 | If the credit union elects to provide a toll-free telephone number in order to deliver the oral disclosures to a covered borrower, does the credit union include the toll-free telephone number on either:

|

|||

| 17 | If the credit union elects to provide a toll-free telephone number in order to deliver the oral disclosures to a covered borrower, is the toll-free telephone number available for a duration of time reasonably necessary to allow a covered borrower to contact the credit union for the purpose of listening to the disclosure? |

Other Limitations

| Item | Description | Yes | No | N/A |

|---|---|---|---|---|

| 18 | Does the credit union abide by the prohibitions against requiring covered borrowers to: | N/A | N/A | N/A |

| 18(a) | Waive their rights to legal recourse under any otherwise applicable law; | |||

| 18(b) | Submit to arbitration or other onerous legal notice provisions in the case of a dispute; or | |||

| 18(c) | Provide unreasonable notice as a condition for legal action? | |||

| 19 | Does the creditor refrain from: | N/A | N/A | N/A |

| 19(a) | Requiring that a covered borrower repay the obligation by military allotment (note that for purposes of this provision of the regulation, the term “creditor” does not include “military welfare societies” or “service relief societies”); | |||

| 19(b) | Prohibiting a covered borrower from prepaying the consumer credit; or | |||

| 19(c) | Charging a covered borrower a penalty fee for prepaying all or part of the consumer credit? | |||

| 20 | Does the credit union refrain from improperly requiring access to a deposit, savings, or other financial account maintained by the covered borrower for repayment by: | N/A | N/A | N/A |

| 20(a) | Obtaining payment through a remotely created check or remotely created payment order; or | |||

| 20(b) | Obtaining a post-dated check provided at or around the time credit is extended? |

Footnotes

[1] The MAPR is calculated in accordance with 32 CFR §232.4(c).

[3] The MAPR largely parallels the APR, as calculated in accordance with Regulation Z, with some exceptions to ensure that creditors do not have incentives to evade the interest rate cap by shifting fees for the cost of the credit product away from those categories that would be included in the MAPR. Generally, a charge that is excluded as a “finance charge” under Regulation Z also would be excluded from the charges that must be included when calculating the MAPR. Late payment fees and required taxes—i.e., fees that are not directly related to the cost of credit—are examples of items excluded from both the APR and the MAPR. But certain other fees more directly related to the cost of credit are typically included in the MAPR, but not the APR. The most common examples of these fees—application fees and participation fees—have been specifically noted in the regulation as charges that generally must be included in the MAPR, but would not be included in the APR under Regulation Z.

[4] The Federal Credit Union Act prohibits federally chartered credit unions from charging a prepayment penalty on any loans (12 U.S.C. 1757(5)).

[5] National Defense Authorization Act for Fiscal Year 2013, Pub. L. 112-239, section 662(b), 126 Stat. 1786.

[7] An overdraft line of credit with a finance charge is a covered consumer credit product when: it is offered to a covered borrower; the credit extended by the creditor is primarily for personal, family, or household purposes; it is used to pay an item that overdraws an asset account and for which the covered borrower pays any fee or charge; and the extension of credit for the item and the imposition of a fee were previously agreed upon in writing.

[8] For purposes of the extended compliance date, the credit card accounts must be under an open-end (not home-secured) consumer credit plan. DoD may, by order, further extend the expiration of the limited exemption for credit card accounts to a date not later than October 3, 2018. For all other credit products, a creditor must comply with the applicable requirements of the July 2015 rule by October 3, 2016 for all consumer credit transactions or accounts for consumer credit consummated or established on or after October 3, 2016.

[9] These reflect FFIEC-approved procedures.

[10] A federal credit union cannot charge a prepayment penalty on any loans pursuant to the Federal Credit Union Act (12 U.S.C. 1757(5)).